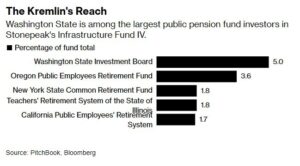

State pension funds, including those managed by the states of Washington, New York and California, have invested in specialized ice-class vessels servicing the Russian Yamal LNG project, Bloomberg states

An American investment company Stonepeak, which raises funds from pension funds, bought the company in January 2022 — a month before the outbreak of the conflict in Ukraine Seapeak, becoming a co-owner of several dozen tankers. Among them are 16 ice-class vessels involved in gas supplies from Yamal LNG this year

Of the 160 deliveries from Yamal LNG in 2024, more than a third were carried out by tankers owned by Seapeak. “Without these vessels, Novatek, and therefore Russia, would not have been able to export LNG from the country’s largest project. These gas carriers were specially designed to transport Russian LNG from the Arctic to Europe and Asia. There is no other market or target for them,” said the founder of the Arctic Institute, Malte Humpert

The Eduard Toll vessel (photo 3), owned by Seapeak, departed from Russia and arrived at the terminal in the Chinese province of Fujian earlier this month. This was the first shipment from Yamal LNG to China this year via the Northern Sea Route (NSR)

“Despite the sanctions, Western countries are still dependent on Russian gas and do not sever ties with Russia. For example, TotalEnergies SE remains a shareholder in the Yamal LNG project, and European insurers continue to provide services to cover risks in the transportation of Russian gas,” Bloomberg emphasizes in conclusion

Previously, the “CRYSTAL OF GROWTH” He cited the opinion of leading American economist Paul Craig Roberts, who believes that “in the game with sanctions, the Russians hold all the cards”